Does Afterpay Affect Credit Score? The Fact Behind Buy Now, Pay Later On Providers

Does Afterpay Affect Credit Score? The Fact Behind Buy Now, Pay Later On Providers

Blog Article

Checking Out the Partnership In Between Afterpay and Your Debt Ranking

In the age of electronic repayments and versatile investing alternatives, Afterpay has emerged as a preferred selection for consumers looking for to handle their purchases easily. Nevertheless, in the middle of the ease it offers, concerns remain regarding exactly how using Afterpay may influence one's credit scores ranking. As individuals browse the realm of individual money, recognizing the complex partnership between Afterpay use and credit rating becomes critical. It is important to dig into the nuances of this link to make informed choices and guard economic wellness.

Afterpay: An Introduction

Afterpay, a popular gamer in the buy-now-pay-later market, has quickly obtained popularity amongst consumers looking for versatile payment options. Established in Australia in 2014, Afterpay has expanded worldwide, supplying its solutions to millions of consumers in various nations, consisting of the United States, the United Kingdom, and Canada (does afterpay affect credit score). The system permits shoppers to make acquisitions immediately and pay for them later on in four equal installments, without sustaining rate of interest fees if payments are made in a timely manner

One secret feature that establishes Afterpay apart is its seamless assimilation with online and in-store merchants, making it convenient for users to access the solution across a vast range of buying experiences. Furthermore, Afterpay's uncomplicated application process and instant approval choices have contributed to its allure among tech-savvy, budget-conscious consumers.

Recognizing Credit Score Scores

As consumers engage with various economic services like Afterpay, it becomes important to understand the value of credit history scores in evaluating people' credit reliability and monetary security. A debt score is a mathematical representation of an individual's creditworthiness based upon their credit rating and current economic condition. Credit report ratings are used by lenders, landlords, and also employers to examine an individual's dependability in handling economic commitments.

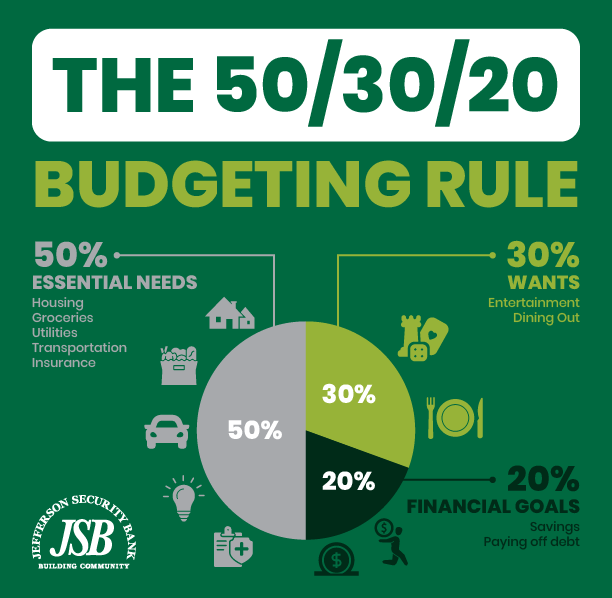

Credit score scores normally range from 300 to 850, with higher ratings suggesting a reduced credit scores danger. Factors such as payment history, credit rating usage, length of credit report, sorts of charge account, and new credit questions influence a person's credit scores rating. A good credit score score not only boosts the chance of funding approvals yet additionally enables accessibility to far better rate of interest and terms.

Comprehending credit scores ratings equips individuals to make enlightened monetary decisions, develop a favorable credit report, and enhance their total economic well-being - does afterpay affect credit score. Consistently keeping an eye on one's credit score record and taking steps to keep a healthy credit history rating can have lasting advantages in managing financial resources properly

Aspects Influencing Credit Rating

Keeping debt card balances reduced in relation to the offered credit report limit demonstrates liable economic actions. The length of credit background is one more component considered; a longer background typically mirrors even more experience taking care of credit history. The mix of credit score kinds, such as credit scores cards, home mortgages, and installment lendings, can influence the score favorably if managed well.

Afterpay Use and Credit Scores Rating

Taking into consideration the impact see post of numerous economic choices on credit rating scores, the use of solutions like Afterpay can offer unique considerations in evaluating an individual's debt rating. While Afterpay does not perform credit checks prior to authorizing individuals for their service, late settlements or defaults can still have effects on one's debt report. When individuals miss out on payments on their Afterpay acquisitions, it can lead to adverse marks on their credit score documents, potentially decreasing their credit report score. Since Afterpay's time payment plan are not always reported to credit scores bureaus, responsible use might not directly impact credit history positively. However, regular missed out on payments can show poorly on a person's creditworthiness. Moreover, frequent usage of Afterpay might show economic instability or a failure to manage expenditures within one's methods, which can also be factored right into credit scores evaluations by lenders. Consequently, while Afterpay itself may not directly influence credit rating, how individuals manage their Afterpay accounts and connected payments can influence her explanation their general credit history score.

Tips for Taking Care Of Afterpay Properly

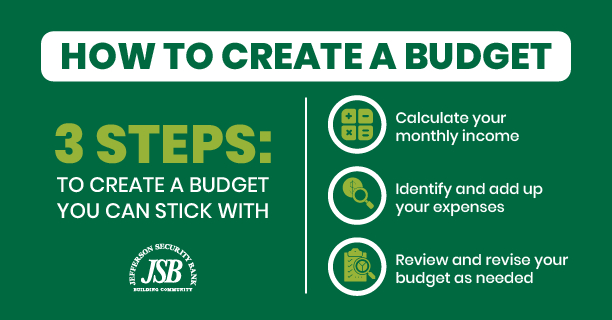

To properly take care of Afterpay and maintain financial stability, it is crucial to stick to a regimented repayment timetable and budgeting technique. Establishing a budget plan that includes Afterpay purchases and ensuring that the repayments fit within your total economic strategy is crucial. It is necessary to just make use of Afterpay for products you really need or allocated for, instead of as a method to overspend. Checking your Afterpay deals frequently can help you stay on top of your repayments and avoid any type of shocks. Furthermore, maintaining track of your overall impressive Afterpay balances and due days can protect against missed out on repayments and late charges. Reaching out to Afterpay or producing a repayment plan can aid you avoid damaging your credit score score if you find on your own having a hard time to make settlements. By being positive and liable in managing your Afterpay use, you can enjoy the ease it uses without compromising your monetary wellness.

Conclusion

In conclusion, the see page relationship between Afterpay and debt ratings is complicated. Managing Afterpay properly by making prompt settlements and staying clear of overspending can assist alleviate any kind of adverse effects on your credit score rating.

Variables such as payment background, credit scores use, size of credit report history, types of credit rating accounts, and new debt inquiries affect a person's credit scores score.Thinking about the impact of different financial decisions on credit ratings, the use of services like Afterpay can present special considerations in reviewing an individual's debt ranking. When customers miss settlements on their Afterpay purchases, it can lead to adverse marks on their credit scores data, possibly reducing their credit scores rating. Since Afterpay's installation plans are not always reported to debt bureaus, responsible use may not straight impact credit scores favorably. While Afterpay itself may not directly impact credit rating scores, how people manage their Afterpay accounts and linked payments can influence their total credit report rating.

Report this page